I’ve been asked many times about budgeting for travel and how we do it. It’s still surprising to me that anyone should care about our bank account, but I guess that’s the world we’re in now because of the blog. We want to help people live their dreams, sharing how we manage financially is part of that.

People are intrigued at how we’ve managed to travel for 2 years on what seems very little money, while still owning a house in Australia and buying another in Romania. It’s pretty unusual, after all.

Some experiences are priceless, and free.

This morning my lovely friend Heidi of Wagoners Abroad was asking about how we, and others, budget. I told her that we don’t. I don’t think she believes me.

Heidi says:

” Everyone has a budget! It is how much you can spend each day/week or month…. if your paycheck is $100 then that is your budget… unless you want to be in debt and spend $150…. it is simple. you probably budget or “keep track” of what you are spending or want to spend.”

Another blogging friend, Manf of Renegade Travels doesn’t budget either, he says:

“(I) Never budget but just spend what we need to. I’ve been spending for long enough to know what’s affordable and what’s not. I know it intuitively I suppose.”

I think we’re the same as Manf.

A long time ago a bloke that I didn’t know from a bar of soap, accused me of setting an unrealistic budget and not doing my research. I still don’t know who he was, but he was an annoying twerp. My money, my system, we do what works for us and I do more research than anyone would believe, although I’m trying to cut down.

So I thought I’d ramble on about budgeting and how we manage money now, and historically, just because I want to put the record straight.

First I want to say that we are not rich, we do not have pots of money nor a significant online income. We don’t have financial support from family, investments or any other business. We did not sell our house, that was something suggested by another blogger this week, as one of the ways families like ours manage financially.

Other experiences are priceless and cost a not-to-be-missed fortune.

We are not digital nomads, but we vaguely hope to be, maybe, one day.

We usually travel long-term, backpacker-style, for that is what we enjoy.

We don’t go on short holidays and we don’t sit still in one spot for long, we find that boring, so there is little time to work online in our travelling life.

If we are based somewhere for a while, as now, I’m a full-time mum and educator, I just don’t have the time to work at growing an empire.

I just put in as many hours as I possibly can.

My husband is a chef, not a job you can do over the internet.

We muddle through on hard work and spending as little as possible.

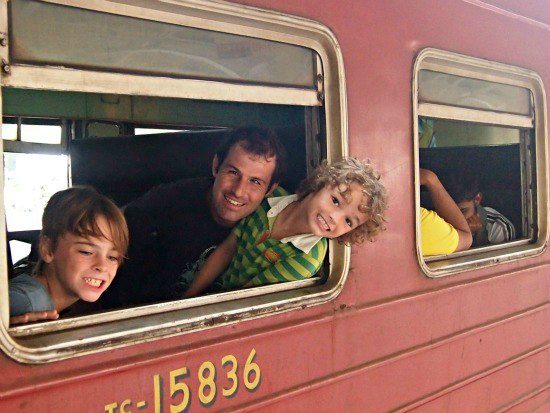

Shared experiences that cost little are worth far more to us than the big house, fancy clothes, swimming pool and flat screen TV

This was when we really cut our spending down to the bone as we saved up the $30,000 travel fund we were aiming for.

We simply took a figure, the minimum figure we thought we could spend each week, I think we started at $200 and over time reduced that further. I took that amount of cash out of the bank every Thursday and that was all I spent.

That figure covered diesel for the car, food, clothes, toiletries, wine, toys, everything we all spend money on every week. ( I include wine because I’m not willing to sacrifice every pleasure in life!)

Obviously the mortgage and utility bills also needed paying, nothing we could do to avoid them, so they weren’t included in that weekly spend. We reduced our consumption of electricity and gas as much as possible, we stopped using things like air-con completely and found ways to cook more economically.

If we were under budget in any week, I’d put the cash in a jar and take out less the next week so that my starting amount was always $200 ( or less, I know we got much lower than that in the end.)

That was the only time I’ve ever forced myself to stick to a budget. I got pleasure out of going without and watching the savings mount up, but it was hard at times too. The boredom of not being able to go anywhere got to me. I’d rather not live that way, but for just a year of mild tedium, we got our freedom.

on how we saved here.

We knew that we would have roughly $30,000 in the bank at the time we left Australia. We knew that we wanted to make that money last as long as possible and set the goal at 2 years. At that time we anticipated spending most, if not all, of our time in Asia travelling incredibly slowly.

$30,000 divided by 2, divided by 365 gave us roughly $40 per day. So that is the goal we set ourselves, to see if we could travel as a family of 4, on around $40/day.

We did OK, some countries are cheaper than others, we came in under $50 most of the time. It’s pretty easy to do in the cheaper parts of SE Asia. We’d stay longer in the cheaper parts, speed through the more expensive parts.

We never kept records nor used any budgeting tools, we just use mental arithmetic, my husband has a good head for figures. I don’t feel any need to have a record other than that created by the bank. I don’t see why you’d need to, unless you were writing a book or posts on the subject, which we’re not.

Expensive treats are most certainly worth it sometimes. I’d rather have our cruise memories than a wardrobe full of clothes.

After just 6 months on the road we ended up in the UK because of family illness. That put us on the expensive side of the world and the ticket to get there hit us in the pocket. That 2 year spending plan went out of the window and we just decided to have a good time!

But having a good time doesn’t necessarily mean spending a fortune, it means spending what you need to spend, no more, no less.

We costed out our first year of travel at just under $100 per day. We were happy with that and you can read about how the money stacked up here. That was roughly the same amount we were spending at home ( including mortgage) during our very boring saving period.

It amazes me that single young people class travelling on $50 per day as “budget”. To us that would be a fortune, $200 a day for the 4 of us, twice what we spent.

We took 2 trans Atlantic cruises and visited 4 continents on that $100 a day.

We’re still very much in hang-the-expense mode. But within reason. We spend as little as possible on things we don’t care about, yet at other times we spend big. We always look for the absolute cheapest deals and find many free things to do, but we’ll happily splurge on an incredible day out for the kids or a special destination.

Last time we were in London I wrote a post about how we were having a fun time on one salary and still saving money to travel, that post is here.

We don’t have a regular or predictable income so we can’t set a budget to meet that. My husband is working full-time at the moment, sometimes 5 days a week, sometimes 7. His hours aren’t fixed and I actually don’t know what he earns.

I can guarantee I’ll earn $300 per month on the websites. Everything on top of that is a bonus ( it can be a lot more) and totally unpredictable. We don’t make decisions based on that income.

Our spending is based on value for money. OK, so 5 days in Dubai cost us a lot, but the experience was amazing and far more enjoyable than spending an extra few weeks sitting doing not-much, anywhere.

I contradict myself sometimes, quite often probably, because life changes, it never stays the same . Sometimes we’re happy to sit still and save money ( that old slow-travel thing) sometimes we need a bit more excitement.

What I’m trying to say is that you need to spend enough to make yourself, and your kids, happy. A friend recently described us as being of above-average happiness. I like that, it made me smile, a lot of that happiness comes from having lovely people like her in our lives.

Money can buy many of the amazing experiences that make up a lifetime of memories and beating yourself up over sticking to a budget that prevents you grabbing those experiences isn’t conducive to a happy life.

So no, I won’t buy myself a new pair of shoes or a haircut, but I will buy a plane ticket. To some it makes no sense, but to us it does. It’s not a budget I’m sticking to, it’s a lifestyle choice.

We have money in the bank, something we’re really particular about, we never spend right down to the bone. If I want to buy the kids another Lego set or take them to the zoo, I can. But I won’t waste money on things I don’t consider important. If it makes us happy we spend, if it’s something of zero importance to us, we don’t.

So no, we don’t budget. I don’t know how much we’re spending at the moment. We’re spending less than is coming in and the savings are increasing, but I couldn’t give you a figure.

We don’t have a budget for the house renovation, we’ll spend what it takes. It could all go totally pear shaped, who knows, who cares? It’ll be an interesting experience and we could end up with an almost free-to-run beautiful bolt hole that will serve us for the rest of our lives, and for our kids lives.

We don’t have a budget for our next round of travel, it could be something dirt cheap, to fill time in an enjoyable way, or some big budget bucket list item. We don’t even know where we’re going next, we haven’t thought about it, although taking the kids to Disney one more time and a return visit to Nepal are highly likely.

We don’t use budgeting apps, spread sheets or even a pencil and paper.

I have a particular dislike for being asked “What’s your budget?” . The last time somebody asked me that question they were trying to sell me a mobile phone. I will always answer “As little as possible”. I know that if I set a budget Mr. Phone Salesman will sell me a phone just 1c under that budget, when the realiy is, I could have spent a lot less.

If you set a budget, you will spend to that budget. Which is why people on good salaries always think they need more.

We just have a good time, our way, on as little money as possible and when the money runs short again, we go back to work.

Rich beyond our wildest dreams.

I think maybe we are.

The “new rich” is a concept I’ve just come across through reading The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich. I know it’s an old book and a best-seller, but I’ve only just discovered it.

We don’t have a business we run remotely on just 4 hours a week, but the book has given me some great take-aways on how to work on the websites more effectively. We do live what many would consider an expensive lifestyle of travel and free time on minimal annual working hours, and that is who the new rich are. We’re living the life,we’re still working on the income.

Our way is working, for now, we’ve found a balance of work: free time : spending that suits us. If it stops working, we’ll change it all around again.

If you want help with budgeting I’d recommend you’d go and see Heidi ( at the link above) she’s far more organised than I am and a lovely person.

I think this is my most random post to date. I got up and wanted to write a post today, the first time in weeks.. I’ve not been well so Chef has taken the kids out for the day and I have time on my hands.

Hope you’re all having fun with your families, wherever you are, we’re looking forward to travelling again soon. This 10 weeks in London has been all about catching up with friends, working on the kids education and social lives and getting the blogs running more smoothly. The $300 guaranteed income mentioned above has happened this month for the first time, along with a 20% increase in traffic. Up till now we’ve had no real guarantees, we’ve always been waiting on the next email, we’ll try to continue to grow that passive income as time goes on.

Got any questions? Stick ’em in the comments!